A self-service platform

for clients of advisory firms

to access digital expertise

Our assurance technology provides a single platform for extracting, digitising and delivering knowledge created by consulting, advisory and training firms, transforming it into high margin revenue streams.

Problem

As resources and clients become distributed in the professional services sector, firms must look for new ways to deliver services and attract customers digitally.

Solution

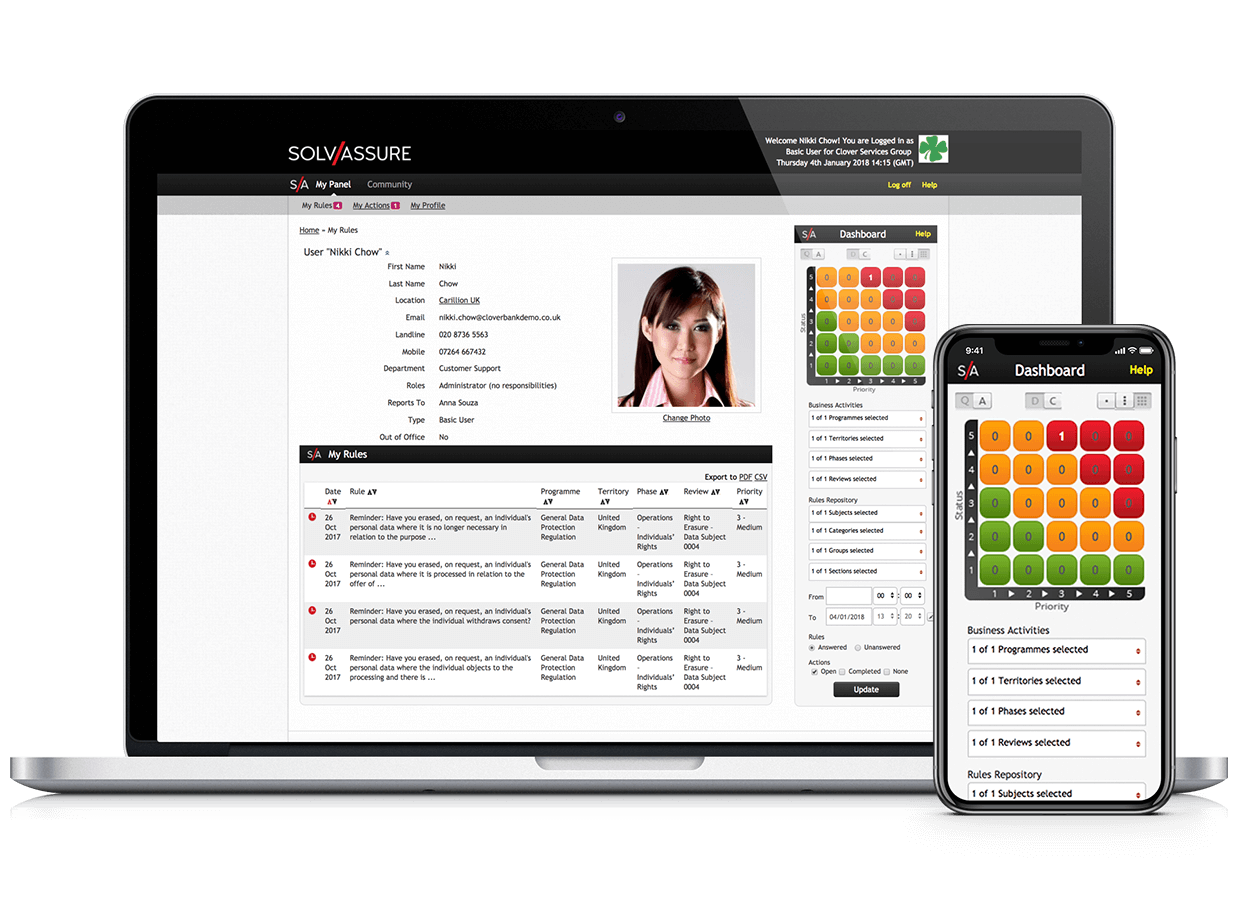

Solvassure enables consulting firms to take on entry level clients and deliver hands free professional services whilst maintaining visibility of clients’ problems in real time.

A cloud based and mobile enabled framework automates the distribution of business instructions from a digital library of licensed expertise.

Features

Our platform is packed with a unique combination of structured, automated and auditable features that you won’t find in traditional collaboration tools like Teams, Zoom, Project or Slack:

Evidence collection

Exceptions prioritised

Calendar and workflow

User communications

Expertise content import

Work-From-Home monitor

Location tracking

Privacy compliance

Committee governance

Incident management

Historical traceability

Automated auditing

Smartphone app

Configurable and re-usable

Benefits

Becoming a next generation digital firm will be a “Kodak” moment for many organisations, it could determine whether their business survives or thrives in the coming months.

Lower cost resource can follow simple automated instructions with easy new starter on-boarding.

Up-sell opportunities from additional content improve product offerings and client retention rates.

Global client recurring revenue is increased using licensed technology and managed services.

A white label intellectual property repository adds value to your business and replicates knowledge easily.

Our powerful platform lends significant advantages over your competitors in a crowded market.

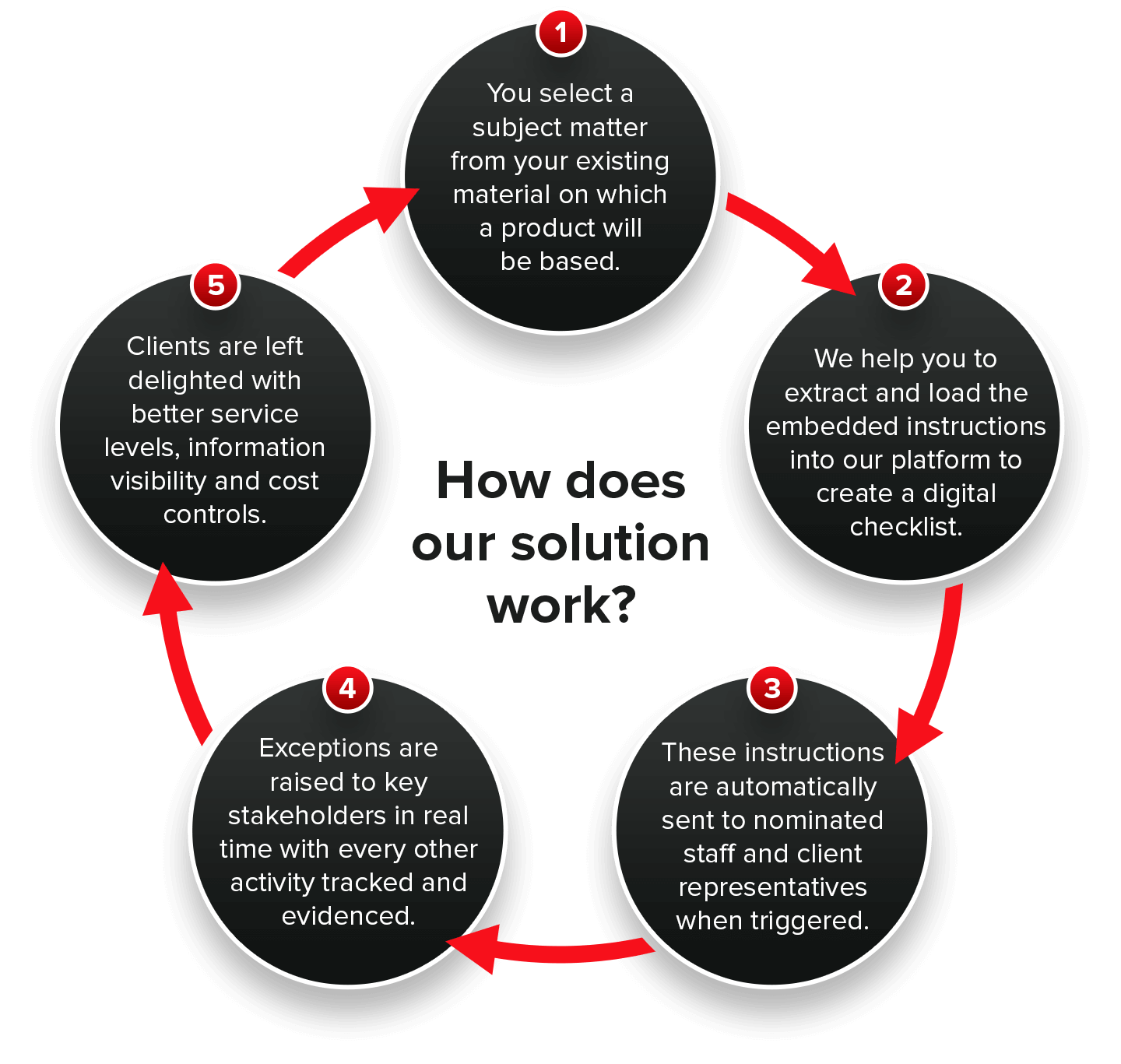

Process

Each of our clients is able to target market opportunities by creating proprietary assurance products in days rather than months, keeping their ideas fresh and their clients engaged.

Modules

Accountability

Privacy

Governance

Contractors

Security

Projects

Partners

We are also working with the University of Reading and Oxford University Press to develop AI that will significantly disrupt the management consulting and publishing industries.

Why choose us? Just ask our clients

Solvassure.

Assurance Technology.